29+ tax return mortgage interest

Ad Our team of tax experts are ready to tackle your questions. Web For example a homeowner with an MCC in Louisiana -- which allows 40 of mortgage interest as a credit -- who paid 10000 in mortgage interest in 2022 could.

Oneok Strong Performance A New Era For Dividends Nyse Oke Seeking Alpha

You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt.

. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Mortgage interest received from the borrower. TurboTax Will Get Your Maximum Refund Guaranteed Or Your Money Back.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. This box shows how much interest you paid to your lender for the year.

Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. As usual my pile of documents included our property taxes medical expenses mortgage interest and donations plus a.

For taxpayers who use. Connect with our CPAs or other tax experts who can help you navigate your tax situation. Web 8 hours agoQ.

If your standard deduction is more than your itemized deductions which also includes state and. Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions. Web IRS Publication 936.

The co-owner is a spouse who is on the same return. Web Basic income information including amounts of your income. Web There are different situations that affect how you deduct mortgage interest when co-owning a home.

Ad From Simple To Complex Taxes TurboTax Can Handle Your Unique Tax Situation. Enter the full amount as it. TurboTax Will Get Your Maximum Refund Guaranteed Or Your Money Back.

State Filing Fee. Web Box 1. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Ad Learn More About Mortgage Preapproval. Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage. The interest on an additional.

If you are married and filing separately then its limited to. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Homeowners who bought houses before.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Secured by that home.

Mortgage interest on home purchases up to 1000000. Web Used to buy build or improve your main or second home and. Browse Information at NerdWallet.

You are required to file a California tax return if you receive income from. Use NerdWallet Reviews To Research Lenders. I filled out my tax preparers organizer.

Web You can only deduct mortgage interest on the first 750000 of your mortgage if you file single or married filing jointly. Take Advantage And Lock In A Great Rate. Web You must itemize to benefit from mortgage interest and property tax deductions.

TaxInterest is the standard that helps you calculate the correct amounts. File with confidence now.

The Nugget Newspaper Vol Xlv No 15 2022 04 13 By Nugget Newspaper Issuu

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

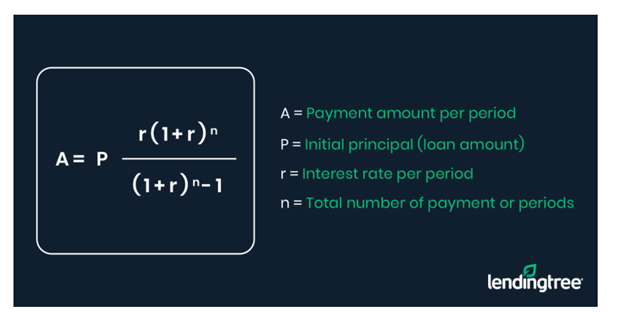

The Home Mortgage Interest Deduction Lendingtree

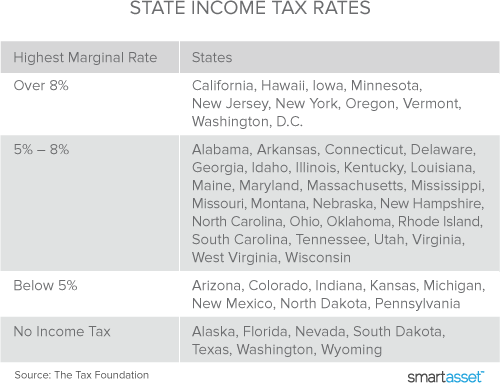

Mortgage Interest Tax Deduction Smartasset Com

Maximum Mortgage Tax Deduction Benefit Depends On Income

Tax Reform With 750k Cap On Mortgage Interest Deduction Would Leave 1 In 7 U S Homes Eligible Zillow Research

Premium Vector Mortgage Payment House Loan Interest Rate Or Balance Between Income And Debt Or Loan Payment Financial Risk Concept Businessman Trying To Balance With Mortgage Interest Rate Percentage On The

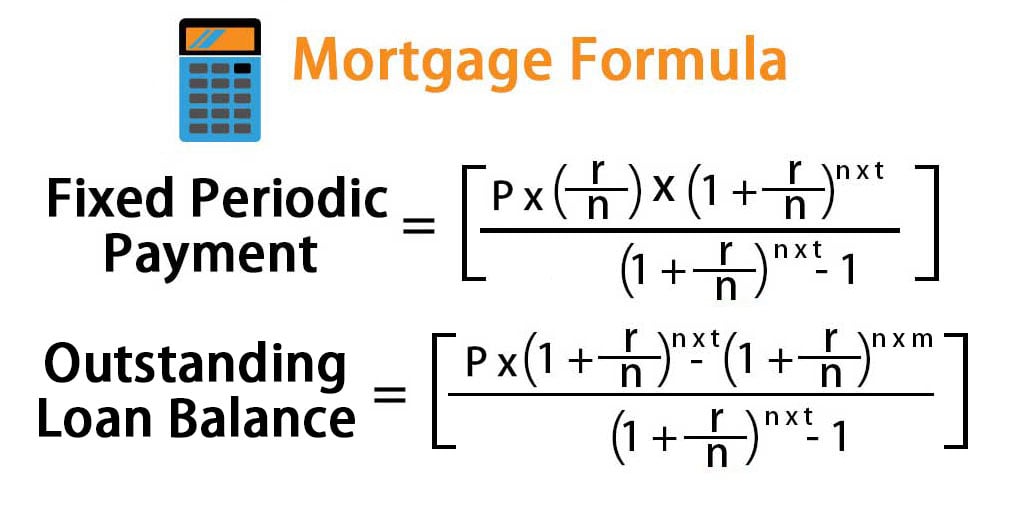

Mortgage Formula Examples With Excel Template

C107365

C107365

The Week On Wall Street A Market With No Conviction Seeking Alpha

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Net Worth December 2021 The Money Commando

Mortgage Interest Deduction A 2022 Guide Credible

10 Amortization Schedule Templates In Pdf Word Xls Google Docs Google Sheets Numbers Pages

Does Mortgage Interest Reduce Taxable Income Or Come Back As A Refund

11 Mortgage Amortization Schedule Templates In Pdf Doc